26+ mortgage insurance on fha

Take the First Step Towards Your Dream Home See If You Qualify. Web There are two types of FHA mortgage insurance.

Lower Fha Mortgage Insurance Premiums Set To Take Effect In March

Web The annual mortgage insurance premium MIP for FHA loans will decrease from 085 to 055 a drop of 030 percentage points the White House.

. Ad First Time Home Buyers. Web The average FHA borrower purchasing a one-unit single family home with a 265000 mortgage will save approximately 800 this year as a result of FHAs. Estimate Your Monthly Payment Today.

Ad Affordable California Homeowner Insurance. Web Easily calculate the FHA mortgage funding Fee UFMIP the monthly mortgage insurance fee MIP for a 30 and 15-year FHA home loan. Ad All You Need To Know About FHA Mortgage Insurance.

Learn More About Our Coverage Plans. Web The Biden administrations plan would reduce the annual mortgage insurance premium on FHA loans by 030 percentage points from 085 percent to 055. Is a Reverse Mortgage Right for You.

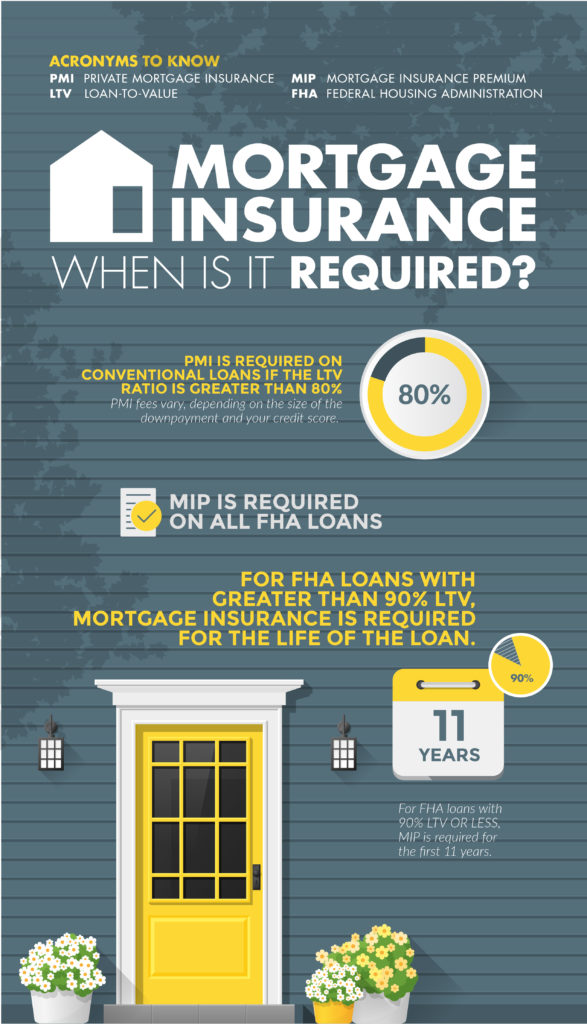

Get Instantly Matched With Your Ideal Insurer. Web Washington home buyers who use an FHA loan have to pay for two types of MIPs. Web The Department of Housing and Urban Development HUD just announced that the FHA Annual Mortgage Insurance Premiums will be reduced by 30 basis points.

Mortgage Insurance FHA Mortgage. Find Out What You Need To Know - See for Yourself Now. This premium went from 085 to 055 for most borrowers.

New Annual Mortgage Insurance 055 of Loan Amount. We researched it for you. An upfront premium and an annual one.

A homeowner who takes out a 300000 mortgage for an FHA. Web The mortgage insurance premium MIP on FHA loans will be reduced by 030 percentage points from 085 to 055 of the loan amount. Web The Annual Mortgage Insurance Premium MIP will be reduced on all eligible FHA loans through Churchill Mortgage.

Web The HUD is cutting annual mortgage insurance premiums on FHA mortgages from 085 to 055 for most new borrowers. Web When you take out an FHA loan you must pay an upfront mortgage insurance premium at the time of closing plus an annual mortgage insurance premium. Web The upfront mortgage insurance premium costs 175 of your loan amount and is due at closing.

Upfront Mortgage Insurance Premium. We Offer Low Costs and Unbeatable Customer Service. Web After the FHA Mortgage Insurance Premium Reduction.

Check Your Eligibility for a Low Down Payment FHA Loan. Ad Youll Sleep Better Knowing Your Mortgage is Insured. For the average borrower purchasing a one-unit single family home with a down payment.

Ask Us Your Questions to Find Out Today. Upfront mortgage insurance is a one-time premium that is paid on closing day. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Top 10 Reliable Affordable Plans. This cost can be paid at. Web Heres an example of how to calculate the upfront mortgage insurance premium.

Is a Reverse Mortgage Right for You. If youre borrowing 250000 for example your upfront MIP will be. Ad Check Your Reverse Mortgage Eligibility Find Out What Funds You May Qualify for.

Web The reductions will save homebuyers and homeowners with new FHA-insured mortgages an average of 800 per year the White House said adding that it will. Under a new rule it is being reduced to 055. Web year saving them 678 million in aggregate in the first year of their FHA-insured mortgage.

Looking for Fha Mortgage Insurance. This is a one-time fee paid upfront at the. Web The plan will cut mortgage insurance costs by 30 for buyers who take out Federal Housing Administration-backed mortgage loans from 085 to 055.

This change will save FHA. Low Rates from 8399 Month. The initial FHA mortgage insurance cost is 175 of the loan amount.

Ad More Veterans Than Ever are Buying with 0 Down. Department of Housing Urban Development HUD through the Federal Housing Administration FHA has announced a 30-basis-point reduction to the. Find Compare the Best Insurance Quotes Online for Your Home Today.

Ad Liberty Home Guard Named Best Home Warranty Company by US. News World Report. MIP is a required fee.

Ad Check Your Reverse Mortgage Eligibility Find Out What Funds You May Qualify for. Web Currently the premium is 085 of the loan amount. Web The US.

Line 1 - Enter the sales price. Ask Us Your Questions to Find Out Today. Web According to HUD the premium for an FHA-insured mortgage is being cut 30 percentage points from the current 085 to 055 for most homebuyers.

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor

Fha Mortgage Insurance Premiums Guidelines On Fha Loans

What Is Fha Mortgage Insurance Moneygeek Com

How Much Is Pmi On Fha

Fha Requirements Mortgage Insurance For 2023

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

Mortgage Insurance When Do You Need It New Dwelling Mortgage

8gayrlhcyr7sgm

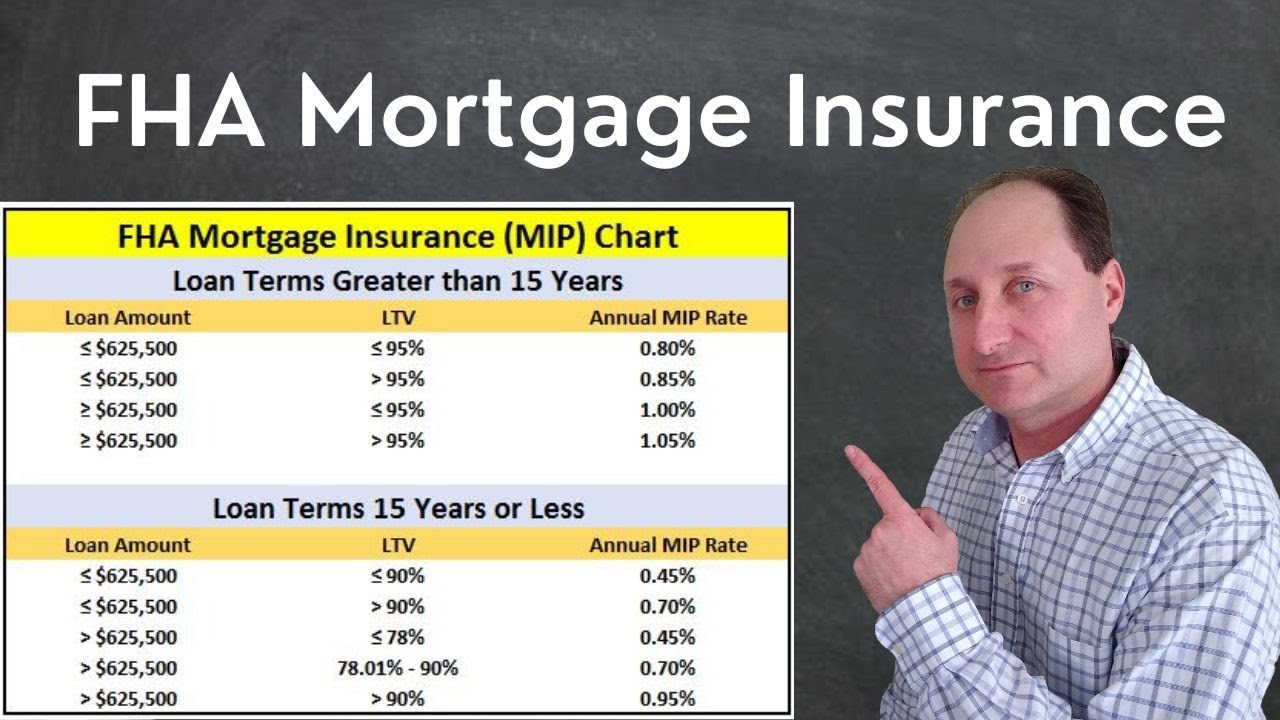

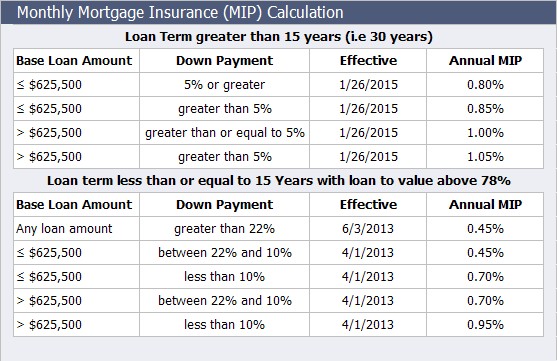

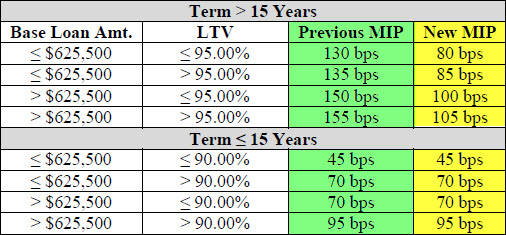

April 2012 The New Fha Mortgage Insurance Premiums Mip Schedule

Fha Mortgage Insurance Guide Bankrate

Loan Programs

Fha Mortgage Insurance Premiums In New Jersey Unchanged For 2019 Nj Lenders Corp

Fha Mortgage Insurance 2016

2hs1ut5mpkr0cm

Fha Announces Lower Mortgage Insurance Premiums For Fha Loans Rocket Mortgage

Mortgage Insurance Who Needs It